Many people look for creditsafe login because they want to reach their credit details fast and in a safe way. Some use it to check how strong their business is. Others use it because they work with companies and want to know if it is safe to trust them.

Most users search because they need help getting into the site, fixing problems, or learning if the system is safe. Some people get confused by sign-in steps. Others worry about safety when using a sign-in to credit services website. They want to know if their data is safe when using business credit platform access tools.

This article explains everything in easy words. You will learn how people log in, what can go wrong, how safe it is, and how to protect yourself. If you are new to credit tools or have used them before, you will find answers here. We will also look at real problems and simple solutions. Many people never think about safety. But when you use customer portal authentication, you must know what risks can happen.

By the end, you will understand the truth — the good parts, the weak spots, and the steps to stay safe when using the login system.

What Is Creditsafe and Why People Log In

Creditsafe is a service that helps people and businesses check credit reports. Credit reports tell if a person or company pays bills on time. Big and small groups use it to learn if someone is safe to work with. When people go online to use it, they need account access for Creditsafe to see the reports.

Think of it like a big phone book for business trust. A company can type a name and see if it is strong with money. People can also check their records. Some use a business credit dashboard to read all their data in one place. This helps them make smart choices.

Logging in gives users tools to track score changes, download reports, or set alerts. Some think it’s only for banks, but that is not true. Shops, builders, and even small local businesses use it. Many believe it is hard to use or only for large firms, but that is another myth. The enterprise login experience is built for many kinds of users, not just experts.

Some log in often to check risk before signing a deal. Others just want to keep an eye on their own company. Many think logging in will fix every money issue, but that is not how it works. It does not give loans or solve debt. It only shows useful facts so people can decide what to do next.

In short, people use Creditsafe to get credit info, avoid risk, and find out if a business is safe to trust. That is why the login matters.

Lets Read Our Latest Post: Quad Warehouse Guide: Hidden Risks & Smart Buying Tips

Accessing the Portal: How the Login Works

People use the Creditsafe access portal on phones, tablets, and computers. The login page is easy to find on the official website. Some users bookmark the page to save time. Others reach it from a link in an email or company dashboard.

There are two main login pages. One is for normal users. The other is sometimes used by bigger teams. Most people only need their email and password to start. Some companies give workers a username instead. The steps are not long, but people still get stuck when they do not know where to click.

This is how most users log in:

- Open the website in a browser.

- Click the sign-in button.

- Type email or username.

- Enter password.

- Press the login or submit button.

Many users visit the page for credit report sign-in because they want to see a company score fast. Some portals also let users save past reports. If someone forgets the page link, they may search for it online, which can be risky if they click fake sites.

Because of that, the system uses secure sign-on mechanisms to stop bad access. Some screens may ask for an extra code sent to email or phone. That helps protect info if passwords are weak.

Simple login interface design tips help new users. Big buttons, short forms, and clear labels make it easier for anyone, even first-timers. The site may also show help links or a “forgot password” option.

Images or screenshots can guide users more. Alt text will be added later to explain buttons and fields in plain words. The goal is to help people enter the site safely without stress or guesswork.

Security & Safety: Is It Really Secure?

When people think about money data, they worry about safety. The login system uses secure user authentication to protect accounts. This means your name, password, and extra checks are used to confirm you are the real person logging in.

Some companies need stronger safety. That is why there are corporate login security tools. Teams with many users can set rules, such as changing passwords often or blocking unknown devices.

Many people also use multi-factor for business services. This adds a second step after the password. For example, a login code can be sent to a phone or email. Even if someone steals a password, they still cannot get inside without the second code.

The site also protects data when it moves between the user and the server. This is done through encryption. So, if a hacker tries to watch your connection, they see scrambled words that make no sense.

There are also checks at the login endpoint security level. The endpoint is the place where your login request enters the system. Firewalls and filters scan traffic and block strange behavior. Bad bots and repeated wrong tries may get stopped quickly.

Internal teams also watch for threats. They test the system to look for weak points before damage happens. They fix problems with updates. If a user sees something odd, support teams can freeze access to stop harm.

Even with all that, there are still risks. Users with weak passwords are easy targets. People who click fake links may land on scam pages. Shared devices can store login data if the user does not log out.

So, is it fully safe? It is strong, but not perfect. The system guards many parts, but users must help. Good password habits, safe links, and two-step checks reduce danger. Safety is shared between the company and the person using the login.

You May Like: Syces Game Shack Review: Is It Safe and Worth Playing?

Common Problems & Real Login Issues

Even with a good system, people face trouble at times. The most common issues happen when passwords are wrong, internet is slow, or the user types the wrong site name. Simple login process troubleshooting can fix many problems.

Some people see odd pop-ups or warning lines. These are called login error messages explained by the system. They help you understand what went wrong. For example, it may say “wrong password” or “user not found.” Reading the message helps you know the next step.

If a user forgets a password, they can follow password reset procedures. Most portals have a “forgot password” link. The user types an email, and then gets a link to create a new password. This helps people get back inside without calling support.

If someone enters the wrong password too many times, the account may freeze. In that case, they might need account lockout assistance. Some users wait for a timer to unlock. Others need support staff to help unlock the account.

Sometimes, users get kicked out if they do nothing for a while. This is called session timeout handling. It protects accounts when people forget to log out or leave their screen open. Logging in again is easy once they go back to the sign-in page.

Below is the required table with clear wording:

Common Issues & Fixes

| Issue | Cause | How to Fix |

|---|---|---|

| Wrong password | Mistyped or forgotten | Reset password or retype slowly |

| Account locked | Too many failed tries | Contact support or wait for unlock |

| Page not loading | Weak internet or wrong URL | Check connection or use correct link |

| Session timed out | User inactive | Log in again |

| Error message on screen | Info mismatch or browser issue | Read the message and follow steps |

Small problems can feel big if people do not know what to do. Clear steps and calm words help users solve issues fast. Many fixes take only a minute when done the right way.

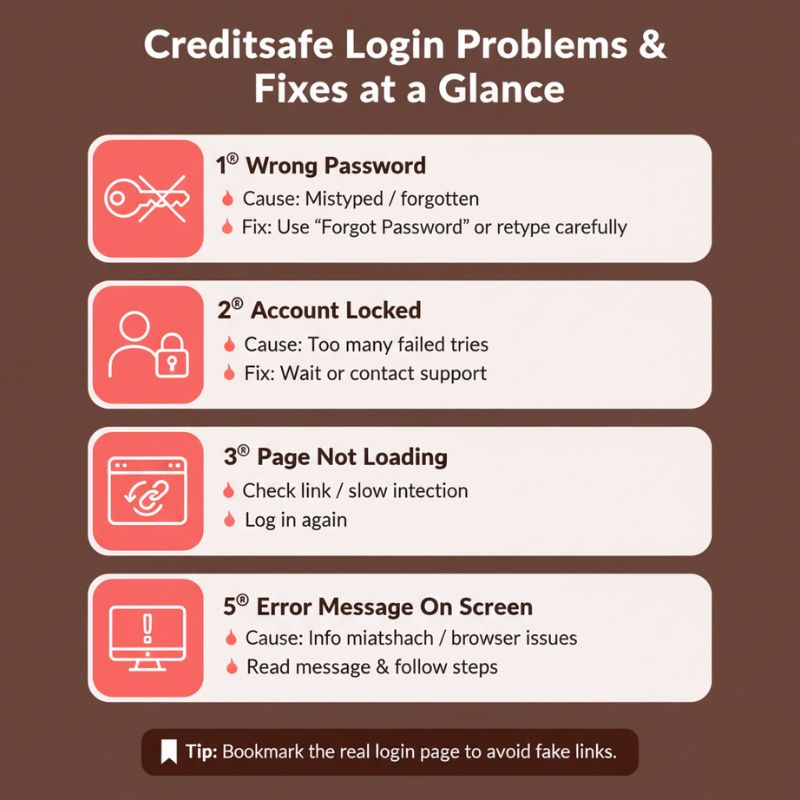

Need a quick fix? Here’s a simple visual guide to common login problems and how to solve them fast:

These fixes solve most login troubles, but if issues continue, follow the recovery steps in the next section.

Passwords, MFA & Account Recovery

Many people forget passwords. It is normal. The system has a password recovery flow that helps users get back inside without stress. When someone clicks “forgot password,” the portal sends a link to their email. The link lets them choose a new password in a safe way.

Some users skip this and try old passwords again and again. That can lock the account. The safe way is to use the official password reset procedures instead of guessing. It takes only a short time if the email is correct.

To stop strangers, the system offers two-step verification setup. This means that after typing the password, the user gets a second code. The code may go to a phone or email. This extra step keeps out attackers who guess or steal passwords.

Some companies use account credential management rules. They ask workers to change passwords often or use strong words with numbers. This helps reduce attacks from inside or outside.

But there are weak spots too. If someone uses the same password on many sites, a leak from one place can affect the login here. If users leave passwords on sticky notes or share them, others can enter without permission. If someone ignores the reset link or uses fake sites, their data can be taken.

The best way to stay safe is simple:

- Use a password only you know.

- Change it when needed.

- Never share it or type it on strange pages.

- Use two steps when offered.

These small habits make logging in safer for everyone.

Also Read: How Horror Memes Shape Digital Culture: Funny or Toxic?

Hidden Risks & Threats Users Ignore

Some risks hide in plain sight. Many people do not think about danger until something goes wrong. One big problem is fake sites. These are sign-in page phishing risks. Hackers make pages that look real. When a user types a password there, the hacker steals it. People fall for this when they click random links or ads that are not from the real portal.

There are also issues with bad identity checks. True identity verification in credit systems helps confirm if someone is who they say they are. But if users skip steps or share login info, the system cannot protect them fully.

Inside a company, not every worker should see the same data. That is why authorized user permissions exist. Admins can choose who can view or change reports. If access is not limited, someone could use the info in the wrong way, even if they work at the same place.

Another risk is weak control over who enters the portal. Good access control for credit portal use stops old accounts from staying active after a person leaves a job. Some places forget to remove old users, and that can lead to leaks.

People also make simple mistakes:

- Logging in on public Wi-Fi

- Leaving screens open

- Saving passwords in unsafe notes

- Ignoring update alerts

Some scams come by phone or email. They ask for login info or say the account is about to close. Users who panic may act fast without checking if the message is real.

Not all harm comes from strangers. An upset worker with access can also misuse reports. That is why tracking and alerts help companies catch problems early.

Most risks can be stopped with care, strong habits, and checks on links and users.

User Experience & Simplicity Factor

A good login page should be easy to use. Many users care about sign-in page usability because they do not want to waste time. Clear buttons, short forms, and readable text make the process simple. If the page looks confusing or crowded, people may think they did something wrong.

The enterprise login experience is built for many kinds of users, not just tech experts. Some companies have teams with different roles. The portal must work for all of them. That means the page must load fast on phones and computers. It should also work for people with vision needs or slow internet.

If a person clicks the wrong button or types slow, the page should still guide them. Small notes, hints, and clean layouts help. Users feel more safe when they see a trusted logo, a clear title, and simple steps.

Still, even a good page cannot stop all trouble. Some users forget how to reset a password or do not know where to click next. That is why user support for login issues matters. Quick help through email, phone, or chat gives people confidence. It also cuts down stress when problems happen.

A strong design also prevents mistakes. If the system tells users when they type something wrong, they can fix it fast. If the session ends after a long pause, the page should ask the user to log in again with clear words.

Good user experience is not only about looks. It is about guiding users, reducing confusion, and helping them finish tasks without fear.

Pros and Cons of Using the Login System

Using the login system has good parts and weak parts. Many users like that they can reach reports fast. Others like that the site uses secure sign-on mechanisms to keep data safe. But some people still struggle with steps or forget passwords.

A big benefit is customer portal authentication. Only the right user can get in. This helps stop strangers from seeing company credit data. It also lets users check scores any time, even at night or on weekends.

Another plus is tracking. Users can save past reports, set alerts, and check if a partner is safe to trust. This helps people make smart choices instead of guessing.

But there are drawbacks too. Some users do not know about login security best practices. They click fake links or use the same password everywhere. If they ignore rules, they can lose access or give data to the wrong person.

Slow internet or old devices can also cause trouble. Some people get stuck when screens load badly or buttons do not work. Others get locked out if they enter wrong info too many times.

Pros vs Cons of Creditsafe Login

| Advantage | Drawback |

|---|---|

| Secure sign-on mechanisms protect data | Users forget passwords easily |

| Fast access to reports | Slow internet can block login |

| Customer portal authentication stops strangers | Fake links can trick users |

| Alerts and saved reports help planning | Some users do not follow safety rules |

| Easy for many business types | Older devices may face issues |

In short, the system works well when people use it the right way. The tools are strong, but users must take care. Good habits make the pros stronger and the cons smaller.

Who Should Be Careful & Why

Not all users face the same risk. Some groups need extra care when using the login.

Small businesses must watch out. They often have fewer tech tools and no IT staff. If they skip identity verification in credit systems, the wrong person might get in. They should also check who has access and remove old accounts when workers leave.

First-time users do not always understand secure user authentication. They may use weak passwords or click links from search results instead of the real site. Simple training and clear steps can stop many problems early.

Corporate teams have more people in one place. That means more logins and more chances for leaks. Good account credential management helps control who can change settings or view reports. If one worker shares a password, many others could enter without permission.

New staff, interns, or temp workers can also cause risk if no one checks their access. If a company does not track who logs in and out, it is easy to miss misuse.

Some users work from home or travel with laptops. If they use open Wi-Fi, someone could watch their screen or steal the password.

Each group has its own weak spots. Knowing them helps prevent mistakes before they turn into bigger problems.

Best Practices for Users (Simple Tips)

People can stay safe with small actions. These steps are easy to follow and work for all user types.

Here are clear tips:

- Use strong passwords with letters and numbers.

- Never share a password with anyone.

- Change your password if you think someone saw it.

- Follow login security best practices from your company or the site.

- Only log in from the real website or saved link.

- Look for the lock symbol in the browser to check secure sign-on mechanisms.

- Turn on multi-factor for business services if the portal offers it.

- Do not save passwords on open or shared computers.

More safety steps:

- Close the tab when you are done.

- Log out after each session.

- Do not stay signed in on public Wi-Fi.

- Check messages before clicking links.

- If a screen looks strange, stop and ask for help.

Easy use tips:

- Follow login interface design tips like reading the labels and buttons carefully.

- Use the “forgot password” link instead of guessing.

- Bookmark the correct login page.

- Keep browser and device updated.

If something feels wrong, report it right away. Quick action can block bigger damage. Safety is not only about the system — it is also about simple habits. A few good steps can protect reports, money info, and trust.

Expert Insight & Real-World Use Cases

Real stories help people understand how the login works in daily life. Many companies use business credit platform access to check partners before deals. For example, a small shop might look at a new supplier’s score before sending goods. Logging in helps them avoid late payments or scams.

Some users log in to watch their own company score. If they see a drop, they can act fast and fix the issue. This kind of credit report sign-in gives control instead of surprise.

Experts say that the login is not just a doorway. It is a tool to plan, check, and protect. One case showed a builder who checked a partner and found signs of money trouble. They chose a safer group and avoided loss.

Another user found a mistake in their own record. After logging in, they reported it and got it fixed before a loan review.

In big companies, teams use the login to manage who can see what. A manager may handle reports, while another member only reads alerts. This keeps data safe without blocking work.

When used with good habits, the login becomes more than a button. It becomes a daily safety step and a smart business tool.

Conclusion

Many people want credit info fast, but they also want safety. The system gives both if used the right way. It has tools that help you check reports, watch scores, and track other companies. It also has blocks, codes, and filters to keep out bad access.

Still, no tool is perfect. Some users forget steps, click wrong links, or use weak passwords. Others do not update their info or log out when done. These small mistakes can open the door to bigger trouble.

The good news is that most problems can be stopped early. Simple habits make a big difference. Strong passwords, safe links, and two-step checks keep accounts safe. Reading messages on the screen also helps solve problems faster.

If you want to use creditsafe login, you do not need to be an expert. You just need smart habits and a bit of care. The system will handle the rest. With the right steps, anyone can use it without fear, stress, or confusion.

FAQs

1. What is the official login link?

The real page is found on the main Creditsafe website. Do not click random ads or links. Use saved bookmarks or your company dashboard to reach account access for Creditsafe safely.

2. Why am I locked out of my account?

You may have typed the wrong password too many times. This triggers a block for safety. You can wait for it to unlock or ask support for help.

3. How do I reset a forgotten password?

Most users can follow the password recovery flow. Click “forgot password” on the login page. A link is sent to your email. You can then make a new password and log back in.

4. Are login error messages explained clearly?

Yes. When something goes wrong, a short line appears on the screen. These login error messages explained in simple words can show if the issue is your email, password, or connection.

5. Is the login safe to use?

The site uses secure user authentication, encryption, and sometimes a second login step. These tools help protect data from the wrong people.

6. Can someone hack my account?

It is hard but not impossible. Hacks often happen when users share passwords, reuse old ones, or click fake links. Using strong steps and multi-factor checks reduces the risk.

7. Does Creditsafe support multi-factor login?

Yes. Some users and companies use a second code sent to a phone or email. This extra step helps stop strangers even if they know the password.

Disclaimer:

This article is for general information only. It does not provide legal, financial, or security advice. Users should follow their company policies and consult Creditsafe or a qualified professional for guidance on account access, login issues, or data protection.

Joseph Quinn is a writer and digital creator best known as the founder of FreakBobTime. With years of blogging experience, he blends technology, culture, and internet humor into unique stories and creative experiments. Through his work, Joseph brings back the playful, weird side of the web while making content that connects with readers worldwide.